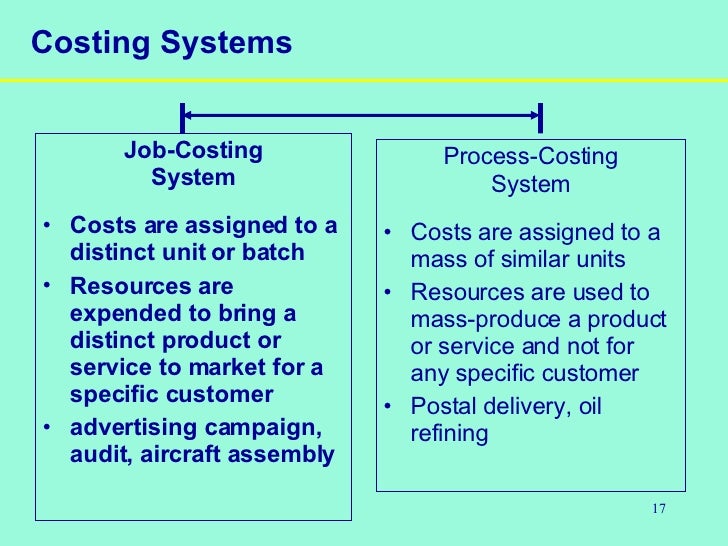

Jack provides a variety of products and services to clientele. Jack Castle owns an electrical contracting company, Castle Electric. Materials and labor can be readily traced to each job, and the cost assignment logically follows. Construction companies and home builders would naturally gravitate to a job costing approach. An aircraft manufacturer would find this method logical. For example, a ship builder would likely accumulate costs for each ship produced. Job costing (also called job order costing) is best suited to those situations where goods and services are produced upon receipt of a customer order, according to customer specifications, or in separate batches.

This chapter focuses on the job costing technique, and the next chapter will look more closely at process costing and other options. Think about an automobile manufacturer what is the dollar amount of “cost” for the hundreds of cars that are in various stages of completion at the end of a month? This chapter, and the next, will provide a sense of how business information systems are used to generate these important cost data. Multiple persons, parts, and processes may be needed to bring about a deliverable output. How does one determine the cost data for products and services that are the end result of productive processes? The answer to this question is complex. In that preliminary presentation, most cost data (e.g., ending work in process inventory, etc.) were “given.” Chapter 18 showed how cost data are used in making important business decisions.

Chapter 11: Advanced PP&E Issues/Natural Resources/Intangibles.Chapter 10: Property, Plant, & Equipment.Chapter 6: Cash and Highly-Liquid Investments.

0 kommentar(er)

0 kommentar(er)